- Release tax-free money from your house at 4.15%

- Ideal for people under 55 and over 55 years old

- No regular monthly payments with LV Equity Release

- Borrow up to 70% of your home’s value.

- Use the money to keep another family member away from a high loan-to-value mortgage

- Stay living in your own home for as long as you like

- It can be used to manage inheritance tax bills

It’s common to encounter individuals looking for lifetime mortgages with flexible drawdown cash release, compliant drawdown cash release, or lump-sum lifetime mortgages. However, Legal & General are keen to see proof of your circumstances through bank statements.

Providers for Equity Release

- Aviva for releasing equity

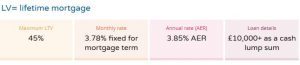

- LV equity release mortgage

- Just Retirement

- Bridgewater

Benefits of Home Reversion Schemes VS an LV Lifetime Mortgage

It can be used to optimise tax planning, and interest rates can be pretty low. Help a member of your family buy their own home that they couldn’t afford otherwise, or pay down your credit cards and loans so you can spend more of your monthly income.

What percentage can be released?

- 60% home reversion schemes, AA equity release loan for a tax-free lump sum

- 30% loan-to-value interest-only lifetime mortgages, Marsden, with the negative equity guarantee

Does LV do Pensioner Mortgages?

Yes, LV Pensioner Mortgages are 4.31% APR.

The 1st and 2nd charge lenders will want to know if the property is a Detached freehold house or a Leasehold flat, and if the resident is a Private Tenant.

Does LV do Equity Release?

Yes, LV Equity Release is 4.31% APR.

Liverpool Victoria Equity Release LV Scheme Providers

It is often found that people seek out lump-sum lifetime mortgages, monthly-payment lifetime mortgages, or monthly-payment equity release; however, Key Retirement, like Zurich, is eager to see evidence of your circumstances in the form of pension statements.

- More2Life Flexi Choice Drawdown Lite Plan with no early repayment charge

- LV Equity Release market with no early repayment charges

- Pure Retirement Equity Release Plans for a lump sum

- Nationwide Equity Release Plans using your property value

- HSBC Flexible Lifetime Mortgage lump sum

- County Gates Barclays Lifetime Mortgage with flexible additional borrowing

- Age Partnership Equity Release Plans for tax-free cash

- More2Life Flexi Choice Drawdown Lite Plan low interest rate

- Pure Retirement Equity Release Plans with a free personalised illustration

- Stonehaven Equity Release via the Equity Release Council

- HSBC Interest-Only Lifetime Mortgage products

- More to Life Tailored Choice Plan with flexible lending criteria

- Equity Release Plans with Lifetime Mortgage Drawdown

- Royal Bank of Scotland Interest-Only Lifetime Mortgage

- L&G Legal & General Flexible Max Scheme

- Stonehaven Equity Release product

- Lloyds Bank Equity Release Schemes

- A NatWest Equity release adviser can tell you about means-tested benefits

- Royal Bank of Scotland Equity Release Schemes

- Bridgewater Equity Release products

- More to Life Flexi Choice Voluntary Payment Super Lite

- Nationwide Equity Release Plans

- Lifetime Mortgage with no monthly repayments

Downsides of LV equity release mortgages

A monthly payment lifetime mortgage can reduce the inheritance for your family. A drawdown lifetime mortgage may impact the ability to claim benefits. You may need to pay a valuation fee, and some products may expose you to interest rate changes.

How much can be released from a family home with LV Equity Release?

The older and unhealthier you are, the more cash you can release with LV Equity Release.

Telephone:

Direct link to Liverpool Victoria website below:

Does LV offer retirement mortgages and LV lifetime mortgages?

Yes, LV Retirement Mortgages are 4.15% MER.

- Zurich Drawdown Lifetime Mortgage

- Key Retirement Solutions

- Lloyds Equity Release Schemes

- Marsden Building Society Equity Release Reviews

- Lv= Equity Release

- Interest-Only Mortgages

- Canada Life Drawdown Lifetime Mortgage

- Santander Equity Release

- Royal Bank Of Scotland Equity Release Interest Rates

- Pure Retirement Lifetime Mortgages

- Equity Release Mortgage Under 55

- Lifetime Mortgages HSBC

- Lifetime Mortgages RBS

- Equity Release Halifax

- Lloyds Bank Equity Release Reviews

- NatWest Home Reversion Plans

- Retirement Advantage Home Reversion Plans

- Yorkshire Bank Equity Release Schemes

- Legal & General Lifetime Mortgages

- Lifetime Mortgage Hodge

- More to Life Equity Release Reviews

- Scottish Building Society Equity Release Reviews

- Telegraph Equity Release Interest Rates

- Lifetime Mortgages Under 55

- Just Retirement Drawdown Lifetime Mortgage

- Aviva Equity Release Interest Rates

- Lv Equity Release Interest Rates

- Bridgewater Equity Release Schemes

- Lifetime Mortgage Crown

- Canada Life Drawdown Lifetime Mortgage

Does LV do Equity Release Under 55?

Yes, LV Equity Release Under 55 is 4.15% APRC.

Does LV offer Lifetime Mortgages?

Yes, LV does lifetime mortgages at 4.15% MER.

LV equity release reviews for an LV equity release adviser

LV (Liverpool Victoria) is a well-established financial services provider in the UK, offering a range of products, including equity release schemes. Understanding client feedback and reviews is crucial for providing informed, tailored advice as an LV equity release adviser.

Reviews of LV’s equity release products generally highlight several vital aspects. Customers often appreciate clear, transparent information about the equity release process.

LV’s commitment to ensuring clients fully understand the benefits and implications of equity release is frequently commended. This level of transparency is crucial for building trust, particularly when making significant financial decisions involving one’s home equity.

Clients also frequently mention the professionalism and approachability of an LV advisor. Knowledgeable and empathetic skills are essential in this sector, as equity release can be a complex and emotionally charged process for many homeowners.

Positive reviews often highlight advisers who take the time to understand individual circumstances and offer tailored advice, rather than a one-size-fits-all approach.

However, as with any financial service, there are also areas where clients have suggested improvements. Some reviews desire more personalised follow-up services or faster processing times.

In an industry where clients’ financial futures are at stake, responsiveness and ongoing support are critical.

These reviews offer valuable insights for an LV equity release adviser. They underscore the importance of clear communication, personalised service, and ongoing client support.

Keeping abreast of client feedback not only helps address specific concerns but also continuously improves the quality of service provided. Being aware of the strengths and areas for improvement in LV’s equity release services enables advisers to meet their clients’ needs and expectations better.