- Release tax-free cash from your house in 2026

- Aviva equity release interest rates 4.57% MER fixed for life

- Ideal for people under 55 and over 55 years old

- No product fees

- No lender’s fees

- Free home valuation

- Making regular monthly payments is unnecessary unless you want to pay interest only.

- Use the cash to pay off loans and credit cards.

- Continue to stay on your property.

- It could be used to optimise tax planning.

How much cash can I borrow?

You can receive 70% of your property’s valuation. For example, if your house is valued at £230,000, you can release £161,000.

Aviva equity release interest rates in 2026 are 4.57% fixed for life – prices from LIBOR and government bond yields

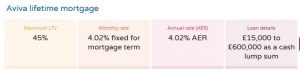

Aviva mortgage on the home below from 2026

Aviva adviser equity release

It is common to find individuals seeking interest-only lifetime mortgages, monthly payment lifetime mortgages, or lifetime mortgages with flexible drawdown cash releases. However, the Telegraph, like Fortify Insurance Solutions, requires documentation to verify your financial situation, typically bank statements.

Providers for Equity Release, like the Aviva lifetime mortgage calculator

- Key Retirement

- Step change

- Age Partnership

- AA equity release cost

Advantages of Aviva Equity Release Schemes

It can be a vehicle to reduce tax bills, and interest rates are often relatively low. It is a low-cost way to help the family buy their own home or pay down their credit card and loan balances, resulting in lower monthly outgoings.

Aviva Equity Release Rates loan LTV similar to Aviva mortgages

- 55% lump sum lifetime mortgages Fortify Insurance Solutions

- 60% loan-to-value lump sum lifetime mortgages Legal and General

- 30% LTV monthly payment lifetime mortgage Scottish Widows Bank

The lender will want to know whether the property is a Freehold terraced house or a Leasehold flat with a share of freehold, and whether the resident is an owner-occupier.

UK Equity Release Lenders like Equity Release Aviva

It is common to find individuals searching for monthly payment equity release products, monthly payment lifetime mortgages, or home reversion plans; however, Aviva, like AA Equity Release, requires proof of your financial situation in the form of investment statements.

- Aviva Lifetime Mortgages for Pensioners Equity Release Call

- Bridgewater Lifetime Mortgage equity release plan

- Just Retirement Equity Release equity release, safe product

- Aviva equity release interest rates, retirement planning

- Stonehaven Interest-Only Lifetime Mortgage optional repayments

- Nationwide Equity Release Schemes move into long-term

- NatWest Equity Release: the value of your home

- Royal Bank of Scotland Equity Release existing customers

- Age Partnership Equity Release Plans standard mortgages

- Canada Life Lifetime Mortgage personal situation

- Just Retirement Drawdown Lifetime Mortgage, the youngest homeowner

- Liverpool Victoria LV Equity Release Schemes medical conditions

- HSBC Interest-Only Lifetime Mortgage: different products

- Age Partnership Equity Release advice

- Just retirement equity release key features

- Nationwide Equity Release Plans: the money you release

- Aviva equity release interest rates new for 2026 tax-free lump sum

- Royal Bank of Scotland Interest-Only Lifetime Mortgage compound interest

- Liverpool Victoria LV= Lump-Sum Plus Lifetime Mortgage reversion company

- More2Life Tailored Choice Plan financial freedom

- Stonehaven Interest Select Plan borrowing jointly

- Nationwide Equity Release Plans offer smaller lump sums

- Age Partnership Lifetime Mortgage standard mortgage

Does Aviva offer Equity Release products, and is Aviva’s equity release calculator good?

Yes, Aviva Equity Release is 4.48% APRC.

Telephone:

Drawbacks of Equity Release Schemes – Aviva Equity Release UK Limited

Aviva equity release calculator options

A monthly payment lifetime mortgage can reduce the inheritance your family receives. A lifetime mortgage with a flexible drawdown cash release may impact the ability to claim entitlements. You may need to pay a valuation fee, and some products may expose you to interest rate changes.

How much is it expected to release from a home – Aviva equity release interest rates

The older and unhealthier you are, the more cash you can release. Aviva equity release interest rates may be lower than those of the lenders featured below.

- Norwich Union Lump Sum Lifetime Mortgages specialist equity release adviser

- More to Life Home Reversion Plans free equity release calculator

- Key retirement two equity release options

- Marsden Building Society Interest-Only Lifetime Mortgages equity release calculator

- Equity Release Under 50 secured against your home

- Royal Bank Of Scotland Equity Release Deals equity release mortgages

- Lv Equity Release Deals much does equity release

- Equity Release Just Retirement equity release is right

- Lifetime Mortgages HSBC equity release mortgage

- Telegraph Lifetime Mortgages equity release provider

- Age Partnership Equity Release financial circumstances

- Hodge Lifetime Mortgages Most lifetime mortgages

- Canada Life Equity Release Plans affect your entitlement

- Lv= Lifetime Mortgages Equity Release Council

- Lifetime Mortgages Lloyds equity release adviser

- NatWest Equity Release Interest Rates, early repayment charge

- Equity Release Scottish Building Society form of equity release

- Equity release options

- Zurich Lifetime Mortgages personal circumstances

- Canada Life Lifetime Mortgages type of equity release

- Yorkshire Building Society Lifetime Mortgage Inheritance Protection

- Equity Release Advisor means-tested benefits

- Pure Retirement Equity Release Interest Rates equity release refers

- L&G Lump Sum Lifetime Mortgages taking equity release

- Under 55 Equity Release Schemes award-winning service

- Aviva Mortgage downsizing protection

- Legal And General Lifetime Mortgage Rates: money from your home

- Lifetime Mortgage Retirement Advantage, in reasonable condition

- RBS Home Reversion Plans are increasingly popular

Lifetime mortgage Aviva

Remortgaging over the age of 60 is possible with many lenders, including Halifax and Santander. In 2026, their remortgage rates could vary depending on economic factors, such as changes in the base rate. It is essential to compare all lenders when seeking this type of loan to ensure you obtain the best available deal.

Age Partnership can provide expert advice and guidance tailored to individual needs, helping customers determine their remortgage requirements. With appropriate advice and guidance, customers should be well informed when making decisions that will have a lasting impact on their finances.

Does Aviva do retirement mortgages and lifetime mortgages?

Yes, Aviva Retirement Mortgages are 4.61% MER.

Does Aviva offer Equity Release Under 55, and do its Aviva lifetime mortgage rates seem reasonable?

Yes, Aviva Equity Release Under 55 is 4.61% MER.

https://www.aviva.co.uk/retirement/equity-release/

Aviva Insurance Limited. Registered in Scotland, under company number SC002116 and has its Registered Office in Pitheavlis, Perth PH2 0NH, United Kingdom.

Does Aviva do Lifetime Mortgages?

Yes, Aviva does lifetime mortgages at 4.61% APR.

Santander offers remortgage options for those aged 60 or over. Although rates and terms can vary with market fluctuations, they offer competitive fixed, variable, and capped-rate mortgages to meet different needs.

Customers over 60 should seek advice from Santander or a qualified mortgage broker to ensure they get the best deal for their situation.

Age Partnership can also provide comprehensive guidance and advice tailored to individual circumstances when considering a Santander remortgage.

Halifax offers mortgages for people over 70. In 2026, their mortgage rates may depend on economic factors, such as changes to the base rate. It is essential to compare all lenders when considering this type of loan to ensure you obtain the best available deal.

If customers have questions about their remortgage options, they should seek advice from trained professionals and specialists who can provide individual guidance tailored to their circumstances. Age Partnership assists customers over 70 looking for a suitable remortgage deal with Halifax.

What is the interest rate on Aviva equity release?

If you use the Aviva equity release calculator, you will find that you can borrow the money at a fixed 4.74% MER for life.

What is the downside to Aviva equity release?

An Aviva lifetime mortgage does have the downside of roll-up interest, which adds to the loan amount over time.

Which is the best equity release company?

Aviva is the best equity release company, offering low rates and free home valuations.

Is Aviva equity release ever a good idea?

Yes, if you need money to pay off debts or an old standard mortgage, it can save you a lot of money.

Does Aviva Offer Equity Release?

Yes, it does, and it has some of the lowest rates available in the marketplace.

Is Aviva’s Equity Release Safe?

Yes, it is entirely safe as it is strictly regulated and has excellent reviews.

What’s an Aviva Lifetime Mortgage?

It is a loan secured on your home. The interest on the loan is added to the amount you borrow, so the loan balance grows over time.