- Release equity from your home with Legal & General Equity Release

- Legal And General Equity Release Interest Rates 4.56% MER Fixed For Life

- No monthly repayments and no regular income required

- Suitable for homeowners under 55 and over 55

- Easy application process

- No application fees

- No lender’s fees

- Any property types acceptable

- Pay off your existing residential mortgage if you have one

- Use the cash for anything you like

- Continue to live in your own home

- 4.76% APRC fixed for life

- Can be used for tax planning and inheritance protection

How much can I release with Legal and General Equity Release?

You can release 65% of your property’s valuation. For example, if your house is worth £320,000, you can borrow £208,000.

Legal and general equity release adviser

Legal and general equity release rates

Legal and general mortgages vs a Legal & General lifetime mortgage

It’s usual to discover people seeking out drawdown lifetime mortgage products with flexible drawdown cash releases, lifetime mortgages with compliant drawdown cash releases, or lump-sum lifetime mortgages.

However, Age Concern, like Maximum Cover Equity Release, is keen to see proof of your circumstances in the form of investment statements and your appreciation for the costs involved for the desired loan amount.

It’s wise to avoid a higher interest rate on the original loan, especially if it has variable rates. Application fees are waived, including for new properties or holiday homes.

Property owned in joint names can also have a lower interest rate. A home reversion plan regulated by the Financial Conduct Authority may not be the best option for older borrowers, as the interest is calculated daily on a loan.

For smaller amounts and greater flexibility, the two main types of loans are secured and unsecured personal loans, which are often suitable for older individuals.

Telephone:

UK Lenders for Equity Release and just the interest retirement mortgages

- Age Concern releases equity plans

- Prudential

- Age Partnership

- L&G lifetime mortgages

- Liverpool Victoria

- legal general equity release

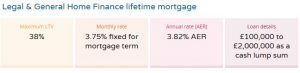

- Using the Legal General Equity Release calculator will reveal an interest rate of 4.76%. Legal & General is one of the best equity release companies, offering a great equity release process.

- Get a fixed interest rate of 4.76%

- The valuation fee is free

- No fixed fee

- No monthly payments

- legal and general mortgages

- Release money with the lowest lifetime mortgage rates

Uses of Equity Release Plan Lenders and optimal legal & general equity release

Often used to manage inheritance tax bills, interest rates can be attractive. Help a family member buy their own home with a modest mortgage or pay off your debts, like loans and credit cards, so that you can spend more of your monthly income.

Legal and general equity release interest rates are 4.76% fixed for life.

Equity Release LTV similar to Legal & General Equity Release mortgages

- 55% home reversion schemes Aegon – find out how much cash and the maximum amount you could potentially release

- 55% LTV home reversion plans The Telegraph

- 60% legal & general equity release

- 55% legal and general equity release adviser

- 25% LTV home reversion plans Hodge

- 55% legal & general lifetime mortgage

The lender will want to know if the property is a semi-detached freehold house or a Leasehold flat, and if the resident is an AST Tenant. Legal and general lifetime mortgage interest rates are under 3% with no fees and a free valuation.

Does Legal & General offer Pensioner Mortgages?

Yes, Legal & General Pensioner Mortgages are 4.76% APRC.

Providers for Equity Release products with a free independent valuation using the Legal and General Equity Release calculator

It’s often found that individuals seek out lifetime mortgages with flexible drawdown cash release, monthly payment lifetime mortgages, or interest-only lifetime mortgages; however, Key Retirement, like Zurich, requires paperwork to demonstrate your circumstances, such as investment statements.

Equity release from Legal & General offers a free valuation.

A simple thing like a Calculator Under 55 can help you make the right decisions.

- Bridgewater Lifetime Mortgage types of equity release

- Canada Life Voluntary Select Gold is releasing equity before long-term care

- legal and general equity release reviews

- Legal & General Equity Release using a financial adviser

- Nationwide Schemes access 55% of the market value of your home

- HSBC – low equity release cost – but the amount you owe will increase over time

- legal and general lifetime mortgage rates

- NatWest Equity Release customers’ reviews

- L&G Legal & General Flexible Plus Lifetime Mortgage release tax-free cash

- Liverpool Victoria LV Equity Release Schemes with a one off lump sum

- Stonehaven Equity Release Scheme with one lump sum or drawdown

- Nationwide Equity Release providers for your retirement planning

- HSBC Equity Release Plans with impact on means-tested benefits

- Royal Bank of Scotland Interest-Only Lifetime Mortgage secured against your home

- Home reversion schemes with the help of an independent financial adviser

- Age Partnership Lifetime Mortgage with no early repayment charges

- More2Life Capital Choice Plus Plan with no early repayment charge

- Canada Life Voluntary Select Gold property value access

- Hodge Equity Release Schemes using great property prices

- Stonehaven Interest-Only Lifetime Mortgage with free solicitors fees

- HSBC Equity Release Schemes with a low minimum age for smaller lump sums

- legal and general equity release rates

- Legal & General Equity Release adviser with no arrangement fees

- Lloyds Bank Lifetime Mortgage, where you pay interest on roll up basis

- Equity Release where you borrow money secured on your home equity

- Barclays’ later-life lending with existing customers and new customers

- NatWest Equity Release Plans provide access to a tax-free lump sum

- Royal Bank of Scotland Lifetime Mortgage for your personal circumstances

- legal and general equity release interest rates

- Hodge Lifetime Mortgage Plus with a low interest rate

- Stonehaven Equity Release options with a big lump sum

- Later life lending without regular payments

- Barclays Equity Release and retirement interest-only mortgages

- Royal Bank of Scotland Mortgage with no penalty for free voluntary partial repayments

- More to Life Capital Choice Plan for typical financial circumstances

- legal and general equity release interest rate

Do Legal & General do Retirement Mortgages?

Yes, Legal & General Retirement Mortgages are 4.76% APR. Get financial freedom by paying off your old mortgage.

Downsides of a Legal & General Equity Release Product

An equity release loan can reduce the inheritance your family receives. Lump-sum lifetime mortgages may affect eligibility for state benefits. You may need to pay a legal fee, and you could be exposed to changes in interest rates with some products.

Legal & General Equity Release LTV – the best Legal and General Equity Release interest rate

The older you are, and the sicker you are, the more money you can release. You don’t need to make repayments to stay in your own home. You can pay off your existing mortgage. A RIO mortgage is similar to a regular mortgage.

Does Legal & General offer Equity Release Under 55 alongside l&g lifetime mortgages?

Yes, Legal & General Equity Release Under 55 is 4.76% MER.

- More to Life Advisor with independent financial advice

- One Family Drawdown Lifetime Mortgage equity release financial adviser

- Aviva Interest Rates with low average interest rates

- NatWest Advisor with free equity release calculator

- L&G low-cost lender monthly equivalent rate

- Scottish Building Society Home Reversion Plans

- Interest-Only Mortgage with fixed early repayment charges

- More to Life Advisor alongside the consumer price index

- Lv Interest Rates, equity release rates

- Lifetime Mortgages Just Retirement for a cash lump sum

- Age Partnership’s best equity release rates

- Bridgewater Advisor monthly equivalent rate

- Marsden Building Society Interest Rates for your outstanding mortgage

- Lifetime Mortgages Santander lifetime mortgage plan

- HSBC with high loan-to-value

- Yorkshire Bank Lifetime Mortgage with no regular interest payments

- Lifetime Mortgage Telegraph with no annual equivalent rate

- Halifax Lifetime Mortgage for loan value with high cash sums

- Pure Retirement Schemes

- Zurich Interest Rates

- Yorkshire Building Society Lifetime Mortgage

- Canada Life

- Legal And General Lifetime Mortgage

- Key Retirement

- Retirement Advantage Schemes

- Canada Life Interest-Only Lifetime Mortgages

- Interest Rates low than standard mortgages

- Under 55 Advisor with a repayment charge exemption

https://www.legalandgeneral.com/retirement/lifetime-mortgages/

Does Legal & General offer Lifetime Mortgages?

Yes, Legal & General does lifetime mortgages at 4.76% APR. You can contact the Equity Release Council to learn more about the no-negative-equity guarantee available with an L&G equity release mortgage.

Is legal general equity release safe?

Yes, of course, it’s safe, as the Financial Ombudsman Service is in place to protect people. Equity release usually refers to a lifetime mortgage with no monthly interest payments.

The costs involved are low to access your house value; the application fees are free. Legally and generally, lifetime mortgages are a series of financial decisions, and the loan continues for the borrower’s lifetime.

Legal And General Equity Release Interest Rates

Key elements of L&G plans:

- Equity release lenders

- equity release provider

- drawdown lifetime mortgages

- equity release deals

- financial services register lenders

- broad lending criteria

- lower legal costs than residential mortgages

- Poor credit history is ok

- Your financial situation is not important

- Pure retirement, marital status is not important

- See the fixed rates in your personal illustration tailored to your individual circumstances

- downsizing protection for the youngest applicant

- No problem if your circumstances change

Do you need a solicitor for L&G equity release?

Yes, you will need a solicitor, but some products offer free solicitor services.

What is the interest rate on Legal and General equity release plans?

The interest rate now is 4.76% fixed for life.

What is the downside of equity release?

The downside of equity release is the roll-up compounded interest added onto the loan.

What does Martin Lewis think of equity release?

He believes you should be very cautious.

What is equity release?

It is a loan secured on your home. You pay it back when you die or go into long-term care.